(855) 285-5700

Mon-Fri 8:00am-5:00pm EST

Payday Loan Rates Alabama

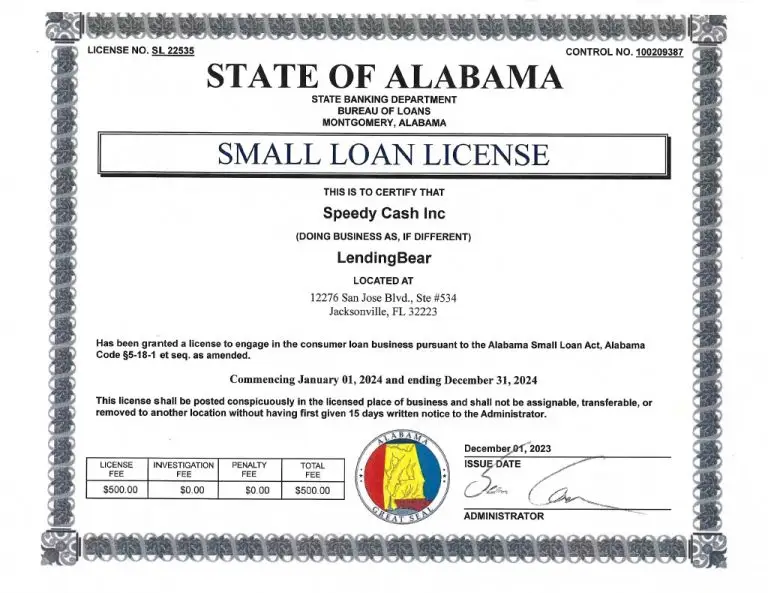

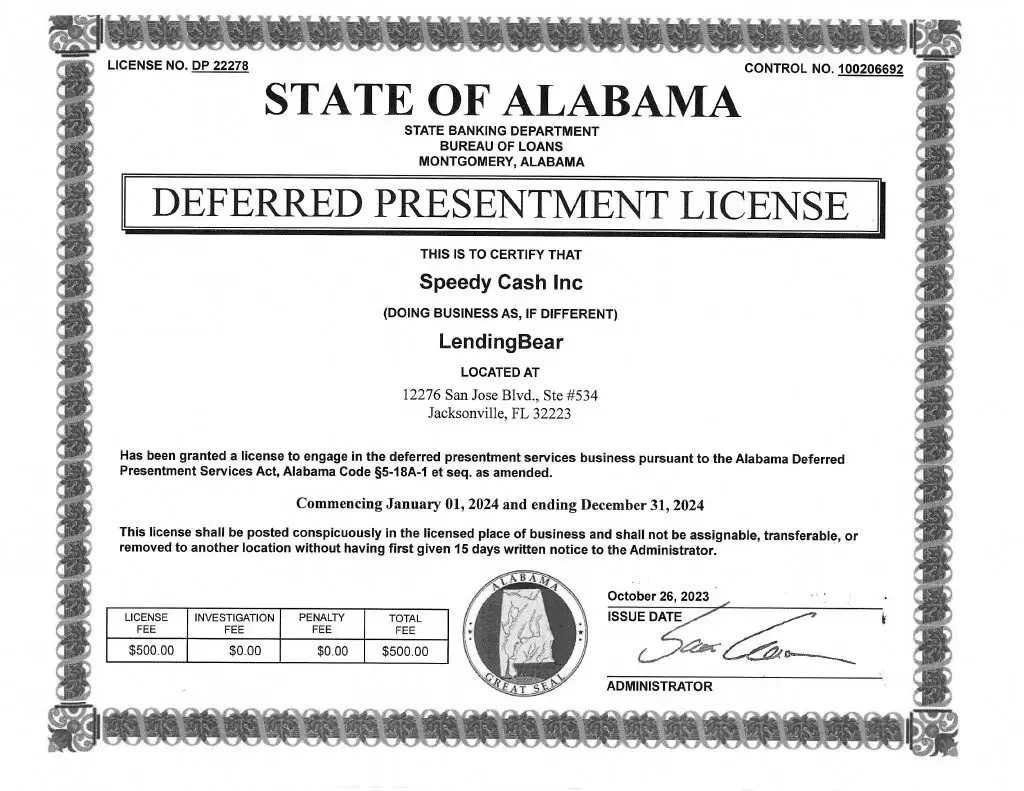

Lending Bear is a state-licensed provider of payday loans in Alabama (known as “Deferred Presentment” loans in Alabama) and title loans in Alabama. Because we are licensed by the state, you can be certain that our practices are ethical, fair, and responsible.

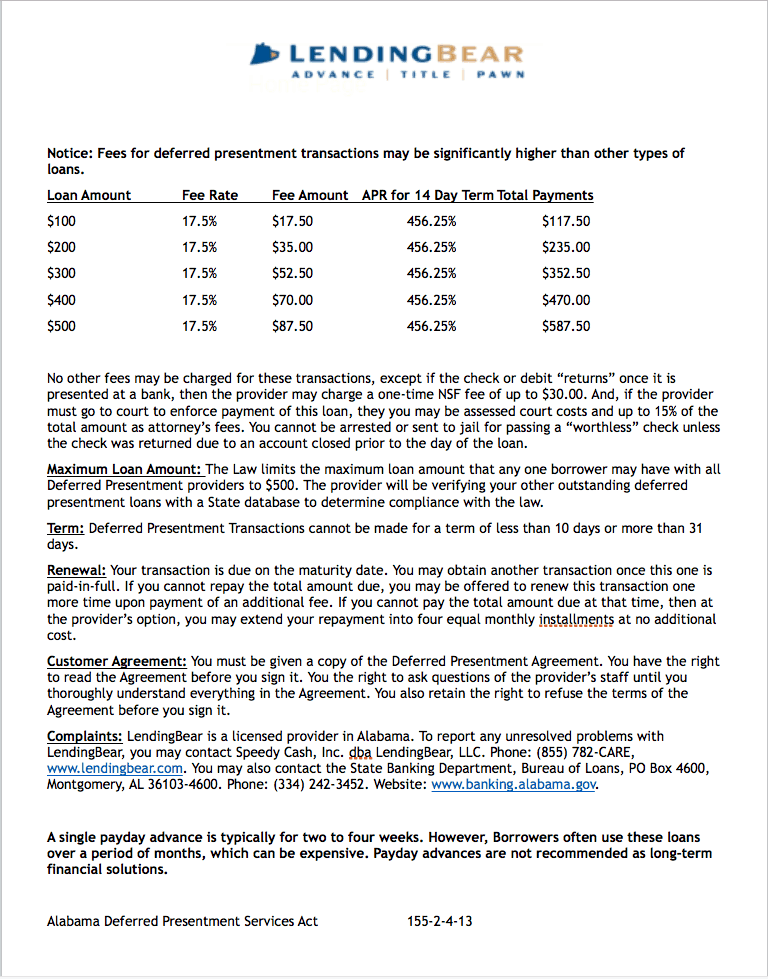

PAYDAY LOAN RATES Alabama

Loan Amount

-

$100

-

$200

-

$300

-

$400

-

$500

Finance Charge

-

$17.50

-

$35.00

-

$52.50

-

$70.00

-

$87.50

Total of Payments

-

$117.50

-

$235.00

-

$352.50

-

$470.00

-

$587.50

Example APR (14 days)

-

456.25%

-

456.25%

-

456.25%

-

456.25%

-

456.25%

ALABAMA INSTALLMENT LOAN RATES AND TERMS

Loan Amount

-

$200

-

$300

-

$400

-

$500

-

$600

-

$700

-

$800

-

$900

-

$1,000

Finance Charge

-

$68.00

-

$78.00

-

$96.00

-

$114.00

-

$160.00

-

$170.00

-

$180.00

-

$190.00

-

$200.00

# of Payments

-

4

-

4

-

4

-

4

-

5

-

5

-

5

-

5

-

5

Installment Amount

-

$67.00

-

$94.50

-

$124.00

-

$153.50

-

$152.00

-

$174.00

-

$196.00

-

$218.00

-

$240.00

Total of Payments

-

$268.00

-

$378.00

-

$496.00

-

$614.00

-

$760.00

-

$870.00

-

$980.00

-

$1,090.00

-

$1,200.00

APR 30 days

-

153.95%

-

119.17%

-

110.36%

-

105.04%

-

101.22%

-

92.57%

-

86.04%

-

80.93%

-

76.83%

ALABAMA TITLE LOAN RATES AND TERMS

Loan Amount

-

$500

-

$1000

-

$1500

-

$2000

-

$3000

Finance Charge

-

$125.00

-

$250.00

-

$375.00

-

$500.00

-

$750.00

Total of Payments

-

$625.00

-

$1250.00

-

$1875.00

-

$2500.00

-

$3750.00

Example APR (14 days)

-

304.17%

-

304.17%

-

304.17%

-

304.17%

-

304.17%

FREQUENTLY ASKED QUESTIONS

HOW MUCH MONEY CAN I BORROW IN ALABAMA WITH LENDING BEAR?

The maximum amount for an Alabama payday loan is $500. The maximum amount for an installment loan is $1,000. The maximum amount for an Alabama title loan is $10,000.

Lending Bear uses the Alabama state database to determine eligibility for payday loans and installment loans.

WHAT IS THE TERM OF PAYDAY LOANS IN ALABAMA?

Payday loans in Alabama must fall between 10 and 31 days in duration. Installment loans range from 4-6 months in duration with Lending Bear. Title loan transactions are set up for 30 days in duration.

CAN I RENEW MY ALABAMA PAYDAY LOAN?

An Alabama payday loan is due in full on the maturity date. A title loan is due in full on the maturity date. You may obtain another loan once the current loan is paid in full.

HOW DO I REPAY MY ALABAMA INSTALLMENT LOAN?

An Alabama installment loan breaks the total finance charges into smaller, monthly payments, to be paid over a longer timeframe versus a payday loan.

HOW CAN I REPORT ISSUES WITH A STORE TO THE LENDING BEAR CORPORATE OFFICE?

You can call the Lending Bear Complaint Hotline 24 hours a day at 855-782-2273. Your identity will be kept confidential.

HOW CAN I REPORT ISSUES WITH LENDING BEAR TO THE STATE OR FEDERAL GOVERNMENT?

Alabama State Banking Department

401 Adams Avenue

Montgomery, AL 36103

Phone: 334-242-3452

Click here to visit – http://www.bank.state.al.us/

Consumer Financial Protection Bureau

Click here to visit – http://www.consumerfinance.gov/complaint/

Working with Lending Bear is so easy!

You'll Love Lending Bear's Easy, Fast & Headache-Free Process

1. Contact Us

Apply online, in one of our stores or give us a call now.

2. Get Approved

Get fast approval with the customer service you deserve.

3. Get Your Cash

Cash in hand or in your bank account the same day.

*In order to receive a same-day online loan, it must be approved by 2:00 pm EST. Eligible loan amounts vary by state and product category.

There are a wide variety of loan products available in the marketplace, so your choice of lending products should match your financial needs. Small-dollar loans used over a long period of time can be expensive.

Google Rating

5.0

Based on 6988 reviews

Lending Bear

5.0

Tyler Turner

1713799950

Very polite lady.ms nicole.fast no problems.very professional..in and out about 20 minuts

Roy Doswell

1713553487

Went there and seen Angela she was the best helped me out drastically thank you Angela your the greatest.

Google Rating

5.0

Based on 6988 reviews

Lending Bear

5.0

Tyler Turner

1713799950

Very polite lady.ms nicole.fast no problems.very professional..in and out about 20 minuts

Roy Doswell

1713553487

Went there and seen Angela she was the best helped me out drastically thank you Angela your the greatest.